Loans

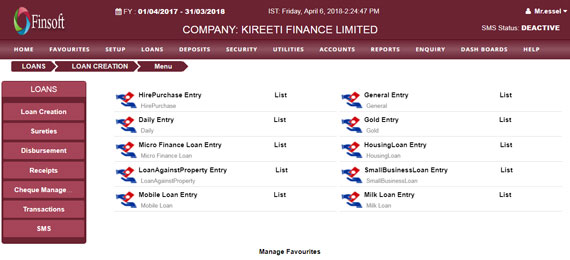

A person borrowed, especially a sum of money that is expected to pay back with interest. Finsoft is dealing with different types of loans as follows like Hire-purchase loan, General loan, Mortgage loan, Gold loan, Mobile loan etc. In accordance with in this the templates can be created and can use those template to create a loan to the customers.

In the Finsoft we are having Daily loans and it having different methods to create their own like Principal + Interest, Principal, On Balance etc. You can create the loans on your own method. Just you have to enter Amount.

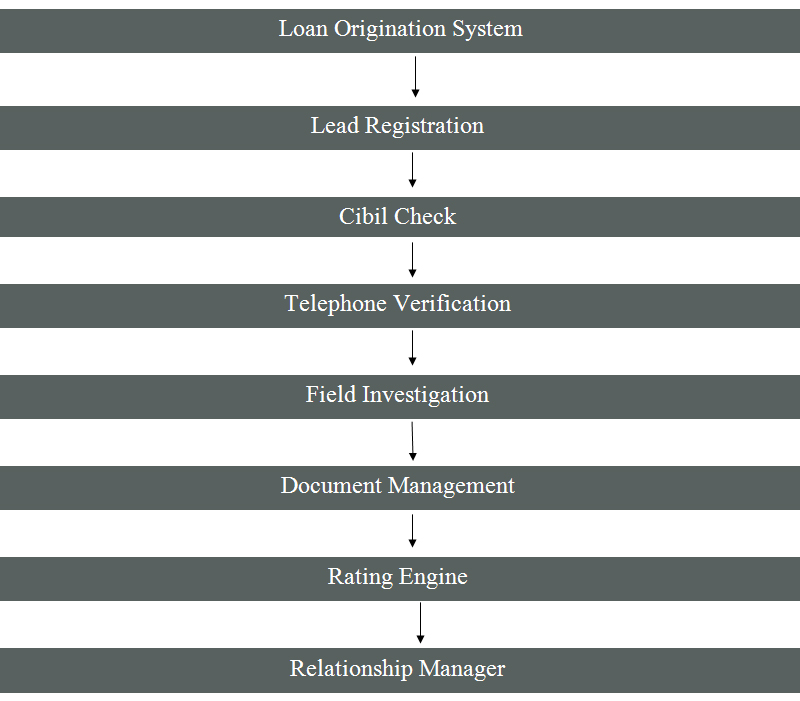

Loan Origination Sysytem (LOS)

LOS module is used to get the Loans through online. The member can register through mobile apps to get loans. By this module the leads can will update the data through different verifications like telephonic verifications, field verifications and submitted to Relationship manager. The relationship manger will update the status whether to approve or reject for the loan.

Loan origination is the process by which a borrower applies for a new loan, and a lender processes that application. Origination generally includes all the steps from taking a loan application up to disbursal of funds (or declining the application). There are many different types of loans.

Loan Origination Sysytem (LOS)

Different types of loans that are present in Finsoft

Hire Purchase Loan

Mainly the loan is used to lend money for purchasing the vehicles. The loan will give according to the cost of equipment. In the registration screen you can view the schedule preparation and can enter the vehicle details.

General Loan

General loan entry is used to lend the money for general purpose. The schedule will prepare automatically according to the loan amount and interest rate given by the user. The user can choose instalments to be only principal, interest or both.

Daily Loan

Daily loan entry is used to lend the money for daily wise loans. It has 3 different methods to lend the money they are Principal + Interest, Principal only, On Balance methods.

Gold Loan

Gold loan entry is used to lend the money by keeping the gold as surety. In this it won’t prepare the schedule and by the end of the payment date it will calculate the principal and interest amounts.

Micro Finance Loan

Micro finance loan entry is used for the group of people. At first we need to create a micro finance group by giving the data with certain group name, principal, interest and number of persons. By the following group name in Micro finance loan entry the data will get automatically in the fields according to the group name given and for the given number of persons.

Housing Loan

Housing loan is used to lend the amount for the purpose of one who want to buy a house.

Loan Against Property

Loan against property is used for the people who would like to lend the amount for the purpose of properties like land, plots or any other properties.

Small Business Loan

Small business loans are ment for the people who will lend the money for the small business. The user will allow the principal and interest amount accordingly.

Mobile Loan

Mobile loan is for the people who want to lend the money to purchase a mobile.

Milk Loan

Milk loan is used for the people who lend the money for the farming community and dairy entrepreneurs.

Benefits of Finsoft

Finsoft is a versatile software solution that cuts down reports preparation time and increases quality and accuracy of information. Defaulters list, Guarantors information, Subscriber- wise ledger, Agent- wise Business, Automatic Intimation Card Generation, Balance Sheet, and Profit & Loss Statement etc. can be generated with. All these will lead to full utilization of man- power, quality and accuracy in information and image among subscribers.

Key Features of Finsoft

- EMI Collection by cheque/Cash

- EMI Collection by PDC

- Easy process for Loan application submission

- Fully Web based real time ERP with Multi-Location Branch/ Collection centre

handling capability - Loan Approval System

- Easy to use software “User Friendly and Powerful"

- Dynamic Settings to create loan schemes, define interest rate & commission

settings - Foreclosure Statement

- Automated Accounting Entries

- Loan Payment History

- Payment Receipts or Monthly Statements

- Penalty/ late fee calculation

- Active loan, Reject Loan, Closed Loan

- Agent information & Agent commission

- Loan instalment schedule with payment details, late fee, processing fee,

cheque return charges. - Auto calculate loan amount based on pledged item's valuation

- Overdue Notices

- SMS and Email Integration Available

- Dedicated Customer Support

- Instalment Scheme, Instalment Due Date, Loan Disbursement, Release

Loan Amount - Facility of exporting the reports into Microsoft Excel, Word, PDF

- Various Type of MIS Report

- Easy Instalment deposit and many more

- More security & transparency

- Loan Maturity Detail